Trade Share CFDs with UptrendsFX

UptrendsFX offers among the best trading environments for CFD trading in more than 10,000 Australian and international share CFDs alongside stock CFDs and indices across 4 continents.

You can trade stock CFDs on the world's most famous companies as well as share CFDs across global markets and benefit from price movements in any direction.

At UptrendsFX, you can trade both Stock CFDs and share CFDs on two powerful platforms from the same trading account, on desktop and mobile (Apple iOS & Android). The stock CFDs come from a range of global markets including London, Hong Kong, Paris, Frankfurt, Madrid, Amsterdam and New York (NYSE & Nasdaq) and cover a wide range of sectors including pharmaceuticals, aviation, tourism and Big Tech. UptrendsFX is once again leading the way with an advanced group of stock CFDs which will give traders illimitable and outstanding opportunities in the universal markets

Equities Trading

UptrendsFX offers exposure to international equity markets with genuine market data, low commissions and competitive margins. See your trades using real market data and trade transparently using CFDs across 4 different continents and over 10,000 stocks. Command higher position sizes by choosing between leveraged trading accounts with competitive financing rates. With the ability to go long and short, you could potentially profit on the price movements of companies from around the globe.

In Australia, the stock market has pre-open and pre-close phases where buying and selling orders are allowed to overlap. A computer algorithm then matches these orders and determines the opening and closing price where the most amount of stocks trade through. UptrendsFX provides access to both these market phases and all the associated extra liquidity.

Globally Regulated

Increase your ability to profit in all market conditions Leverage options up to 20:1

Direct Market Access (DMA) Execution (Iress platform only)

Real-time, transparent share prices Control, Functionality and deep liquidity Full Market depth & see your orders in the queue

Advanced Platforms & Technology

MT4, MT5, WebTrader & Iress with superior client portal

24/7^ Multilingual Customer Support

MT4, MT5 & Webtrader with superior client portal

Global Exposure

Low margins and competitive commission 10,000+ products on global stocks across 4 continents

Earn Dividends

On long positions No ownership of physical shares necessary

Here Is an Example of Share CFD Trading

Transaction

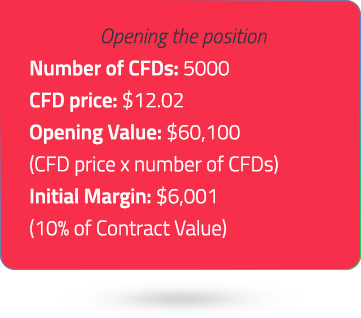

The market price for shares in company XYZ on the NYS is currently trading at $12.00/12.02. You think that the company’s shares are undervalued and will increase so you decide to buy 5000 CFDs at $12.02 each (being the price at which UptrendsFX is willing to enter into the CFD).

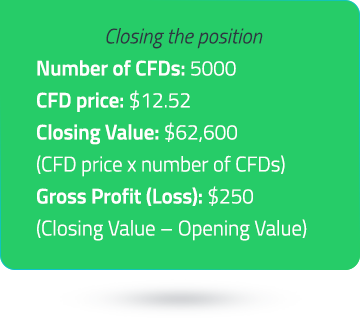

Two weeks later, shares in company XYZ have increased and are now selling at $12.52. You decide to realise your gain by Closing Out your CFD position.

UptrendsFX quotes you a price of $12.52/CFD (being the price at which UptrendsFX is willing to sell you CFDs to Close Out your 5000 CFDs). You trade at that price. The amount of profit you have made, before adjustments and tax, on the Transaction is $2500.00 (difference between 12.02 and 12.52) x 5000 = $2500). With a Margin requirement of 10% of the Contract Value, the Margin requirement for the XYZ position is $6010.00 ($60,100 x10%).

Adjustments

Company XYC paid a dividend of 10 cents per share while your position was open. Therefore you are entitled to a positive dividend adjustment of $500 (5000 x 10 cents) (this amount is posted to your Trading Account). Share CFDs are subject to a commission charge (we also call it a Transaction Fee) on the opening and closing Transactions (based on the Closing Value).

The transaction fee on this trade will be of a minimum of $15 USD or 2cents a share (depending on the greater value. In this case 5000 units* 2cents = $100 USD will be the commission charged for opening the trade as this is greater than $15 USD.

Since you hold a long Share CFD position overnight, costs are charged by way of the Finance Charge. This is calculated on your positions by applying the applicable Finance Charge rate to the daily Closing Value of the position. The formula to calculate financing is: (Quantity x Closing Price) x ((UptrendsFX Base Rate +/- Client Mark up) / number of days for Terms Currency)

In this example, for instance if the applicable rate is 4.5% p.a. and the Closing Price of the CFD on a particular day is $12.20, then the overnight Finance Charge is then calculated as follows: The base rate is 2.5%;

Client Mark up is 2.0%

(5000 x $12.20 x 4.50%) / 365

The Finance Charge on this particular day would therefore be $7.52.